The beta β of an investment security ie a stock is a measurement of its volatility of returns relative to the entire market. And the beta of individual stocks determines how far they deviate from the broader market.

Beta What Is Beta B In Finance Guide And Examples

Beta is represented as a number.

/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)

. Mass and shape Flag question. For data from skewed distributions the median is better than the mean because it isnt influenced by extremely large values. It is used as a measure of risk and is an integral part of the Capital Asset Pricing Model CAPM Capital Asset Pricing Model CAPM The Capital Asset Pricing Model CAPM is a model that describes the relationship between expected return and risk of a security.

Rating candidate answers against a scale. Beta Beta is a measure of a companys common stock price volatility relative to the market. Group of answer choices.

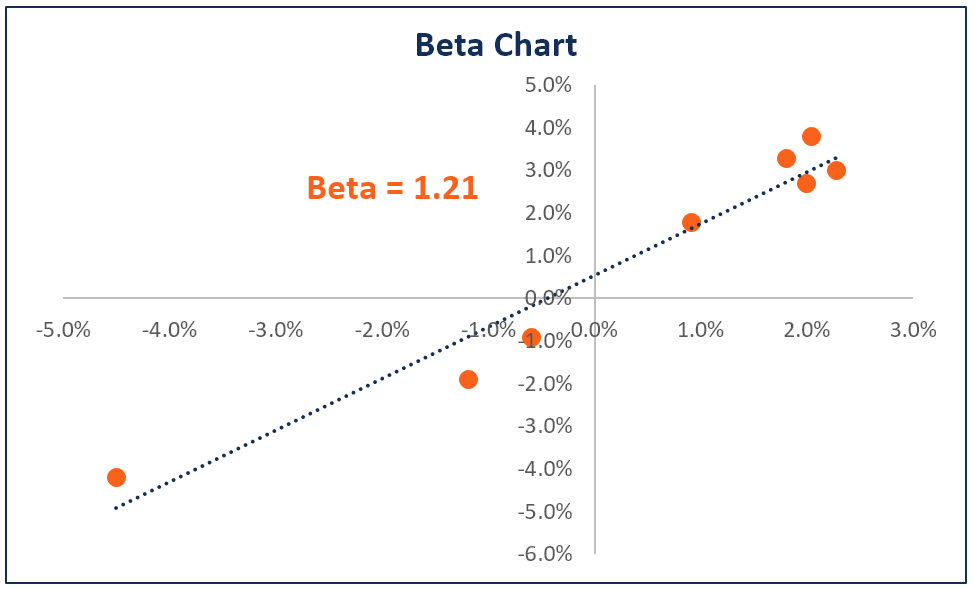

Based on beta analysis the overall stock market has a beta of 1. A beta of 1 indicates that the assets returns and volatility are in unison with the market. It is calculated as the slope of the 60 month regression line of the percentage price change of the stock relative to the percentage price change of the relevant index eg.

All of the following will most likely improve the structure of an interview EXCEPT ________. Beta is measured against a benchmark. Which of the following affects the S value of a particle.

It is used in the capital asset pricing model. Using the same questions for all candidates. In other words the default Beta of the stock market or the benchmark will always be the numeric value 1.

Aerosol 01 to 05 ml in 3-5 ml solution. -used to simulate the heart. The primary and most renowned statistical measure for risk is beta which measures the volatility of an assets returns relative to the entire market or index.

In this section we are going to see a list of the top 50 frequently asked Software Testing questions in MCQ style with the correct choice of answer among various options along with suitable Explanation. So if the NIFTY 50. Asking candidates to describe themselves.

Which of the following statements concerning risk are correct. Software Testing MCQ Part-2. Not commonly used as a bronchodilator.

These Software Testing questions and answers emphasize all the areas of a specific topic. Systematic risk is another name for non-diversifiable risk. Non-diversifiable risk is measured by beta.

Group of answer choices. Diversifiable risks are market risks you cannot avoid. The FTSE All Share.

A stock with a beta equal to 1 assumes its price moves hand-in-hand with the market. The mean is the most frequently used measure of central tendency because it uses all values in the data set to give you an average. Epinephrine hydrochloride Adrenalin Chloride Sus-Phrine - simulates all 3 adrenergic receptors.

For example if the Beta of a Mutual Fund scheme is 1 it means the fund moves in line with the benchmark. Less than 1. Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole.

The risk premium increases as diversifiable risk increases. Multiple Choice I and III only II and IV only I and II only. Beta can be the following.

Using a standardized interview form. Increased HR Hypertension Anxiety. - duration of action is 30 mins to 2 hours.

Since the Mutual Fund returns are measured against the benchmark the value of Beta can be anything. Question 2 Which of the following qualities is most frequently used to measure the amount of a substance in a solution. Adding it to your portfolio may not add much risk.

/BetaFinvizScreener-18bccb1de131439b826baa0193e877a1.jpg)

How Does Beta Measure A Stock S Market Risk

/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)

How Does Beta Reflect Systematic Risk

Whats The Difference Between Alpha And Beta Investing Money Strategy Network Marketing Tips

0 Comments